Digitise your Financing

We eliminate the relatively higher costs typically associated with funding businesses and reduce blindspots during due diligence which heighten the risk of default

We do this by:

What we offer:

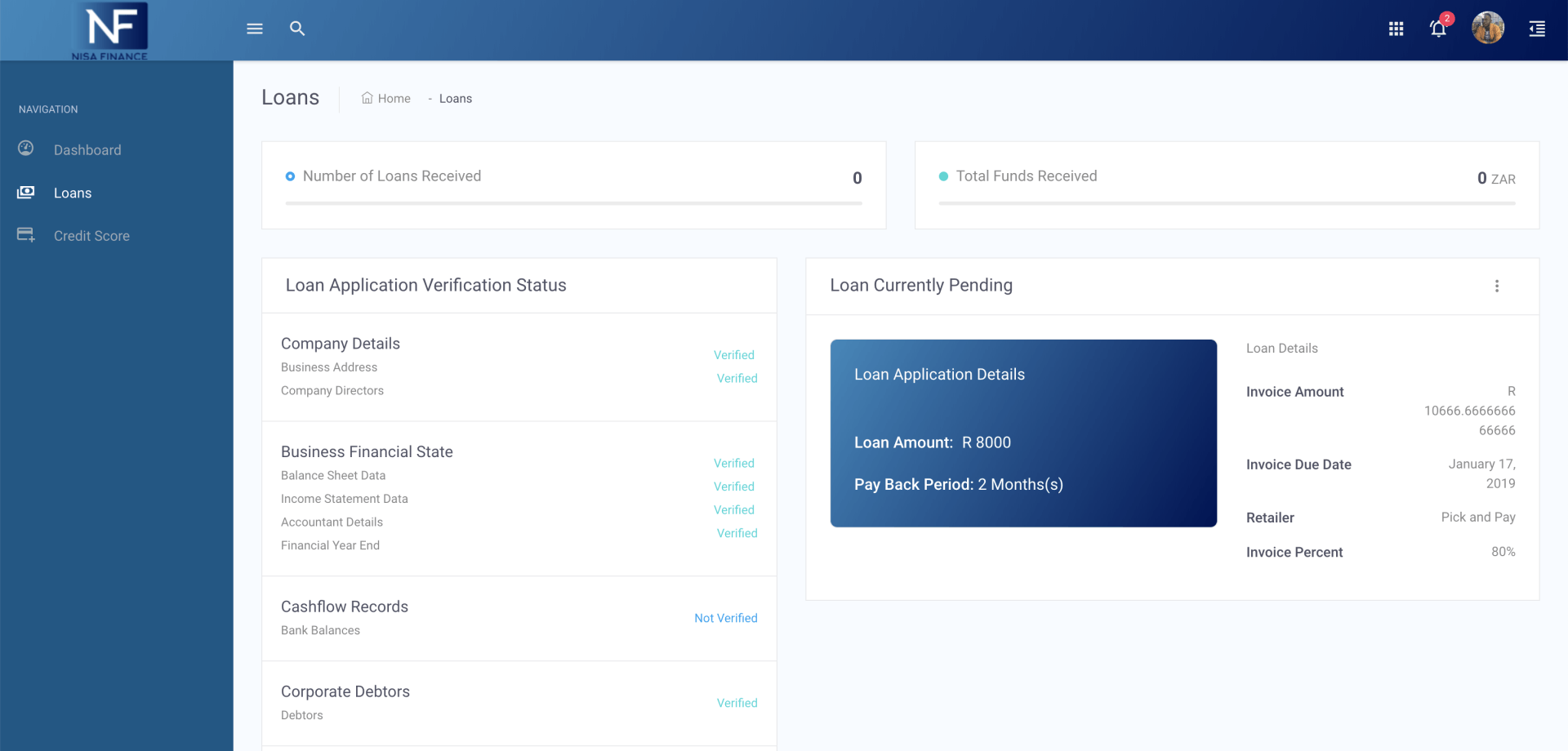

- Verifying KYC and credit-related data in real-time

- Verifying financial and transactional data in real-time

- Authenticating documentation received from applicants for the purposes of due diligence

- Contracting and onboarding approved borrowers to a digital loan book

- Managing digital loan book - including sending automated collection reminders

This means lower financing costs and greater margins without a lengthy software build. Nisa's end-to-end solution is available as a whitelabel, allowing for faster turnaround times on your website to improve efficiency and impress clients.